The Audit Connection Blog

Are your GAAP statements ready for prime time? Here are a few resource reminders!

As you work to wrap up your reporting year, we want to remind you about resources you might find helpful. The resources covered in this article are specifically for governments preparing statements under generally accepted accounting principles (GAAP). ... CONTINUE READING

Do you need a federal single audit for 2020 or 2021? You might for the first time! Prepare early with these 5 tips.

Federal single audits are a bit different from other types of audits, as they are compliance driven. The grantor determines which requirements you must follow, and auditor decides which of those we will audit. Our audit will evaluate and test the internal control processes you put in place over each grant requirement, as well as test that you are in compliance with it. Here are five tips to help get you started. ... CONTINUE READING

Keep the conversation going forward

Do you ever feel like you keep having the same conversations about shared projects over and over? You spend half your time just talking about the same ideas you chewed on last time with little forward progress. And now with the addition of a video conference platform, conversations can feel even more frustrating and less productive. What can you do? This article will introduce three continuous improvement tools that focus on helping a team make incremental progress. ... CONTINUE READING

Video reviews change management model

Did you know we published blog series on change management in 2020? If you did and followed along (and even if you didn’t) check out this short video that reviews the ADKAR model of change management. ... CONTINUE READING

Recently filed your 2020 annual report? Check out your data in FIT.

If you are a local government user, the Financial Intelligence Tool’s (FIT) role-based functionality allows you to access your 2020 data right now! ... CONTINUE READING

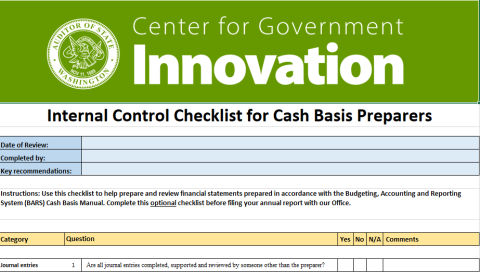

Help is on the way! Checklist for Preparing Cash Basis Financial Statements updated

We know a strong internal control system is important for accurate financial reporting. Not sure where to start? Don’t worry ― we have a tool for cash basis reporters that can help. ... CONTINUE READING

Visualizing Washington's Unemployment Benefit Programs in 2020

This presentation tells the story of Washington's Unemployment Insurance program during the COVID-19 pandemic in 2020, from the first American coronavirus patient diagnosed January 21 through the end of the year. ... CONTINUE READING

Vulnerabilities in federal law, gaps in state fraud detection led to losses in unemployment insurance program, audits find

Emergency federal unemployment programs launched early in the COVID-19 pandemic included provisions that opened state unemployment benefits to fraud, the Office of the Washington State Auditor found in three audits released today. ... CONTINUE READING

Spring 2021 newsletter now available

We curated this latest issue of our regular newsletter to make it easy to find key information from this blog, all in one place! Please download or share with colleagues who might find it valuable. ... CONTINUE READING

Cash Basis BARS, PEBB participating governments likely have an Other Post-Employment Benefits (OPEB) liability to report on their Schedule 09

The most common OPEB benefit provided by some local governments is through the Public Employees Benefits Board (PEBB) plan. This plan provides OPEB benefits through implicit and explicit rate subsidies for retirees. Even though retirees pay 100 percent of their premiums, that payment is not the full cost of the benefits. Retirees pay less because participating employers like you pay a little extra. That little extra is OPEB. ... CONTINUE READING