The Audit Connection Blog

Making the most of your new technology

During the past year, you have worked hard with your team to keep existing services going and rolling out new services quickly. From reimagining service delivery to taking paper-based, internal processes on-line, 2020 was a year of non-stop change. ... CONTINUE READING

Top 12 most important financial policies

According to the Government Finance Officers Association (GFOA), it’s a best practice for governments to formally adopt financial policies. We couldn’t agree more. Financial policies create expectations for government operations, provide a foundation for making financial decisions and help ensure good financial management. Here are the top 12 we consider essential. ... CONTINUE READING

Think you're too small to segregate duties? Let's find out!

Just because your government has a small staff does not mean it is impossible to implement this important internal control. It mostly depends on the decisions you make. Segregating duties is not an ‘all or nothing concept’ – you can segregate responsibilities as much as you can and then fill in any gaps with oversight controls. ... CONTINUE READING

How to get your team ready for the next wave of change

We are now getting to the point where both staff and the public are starting to anticipate a return to normal operations. As we head that direction, the pressing questions will become: What changes we made during the pandemic do we keep? Which changes should we undo? And which changes aren’t working well but the old way wasn’t working either? After a year of unpredictable change, more change is coming, but now we can more proactively manage that change. ... CONTINUE READING

It's time for spring cleaning!

Spring is a time of renewal and energy, plants come alive and start to bloom, the green grasses grow, and the air has a fresh, clean scent. Spring is a great time to dust off the cobwebs of last year, and start afresh. If you’ve filed your annual report, then it’s a good time to kick off some spring cleaning at your workplace. Here are some ideas for you to consider. ... CONTINUE READING

Do your internal controls have a first name?

Do you ever wonder if a key control can be a person? Maybe you have a long-standing employee that everyone goes to for answers, or perhaps an employee that really knows and understands a certain process. People are most certainly an important part of the control system, and governments benefit from these valuable employees that contribute so much. When asked about your internal controls by an auditor, however, your response should not be the name of a person. ... CONTINUE READING

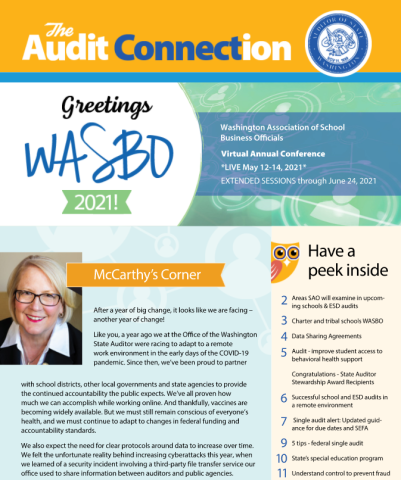

Schools and school districts: Check out the 2021 special edition of our newsletter just for you

In this special edition of our Audit Connection newsletter, we offer a range of articles personalized to schools and school districts. ... CONTINUE READING

How charter and tribal schools fare under public audit

Recent audits of tribal schools reflect that the schools keep records to support revenue and expenditures, and that the schools have quickly implemented audit recommendations. Recent audits of charter schools reflect that school personnel are still learning about Washington’s legal requirements. ... CONTINUE READING

In our new remote work world, are your key controls ready for audit?

As we operate in a more virtual and electronic environment, some of your control system documentation might go by the wayside. While less paper can be good, it’s important to keep some evidence of your key controls in action. ... CONTINUE READING

Areas SAO will examine in upcoming schools and ESD audits

School districts have asked the State Auditor’s Office for as much clarity as we can provide on what we plan to audit each fiscal year. Like districts, SAO relies on the Office of the Superintendent for Public Instruction for clear rules and guidance to provide the criteria for the audits. ... CONTINUE READING