Auditor announces adjustment to hourly billing rate

Aug 13, 2019

This week, Auditor Pat McCarthy notified local governments of a coming adjustment to the hourly local audit billing rate.

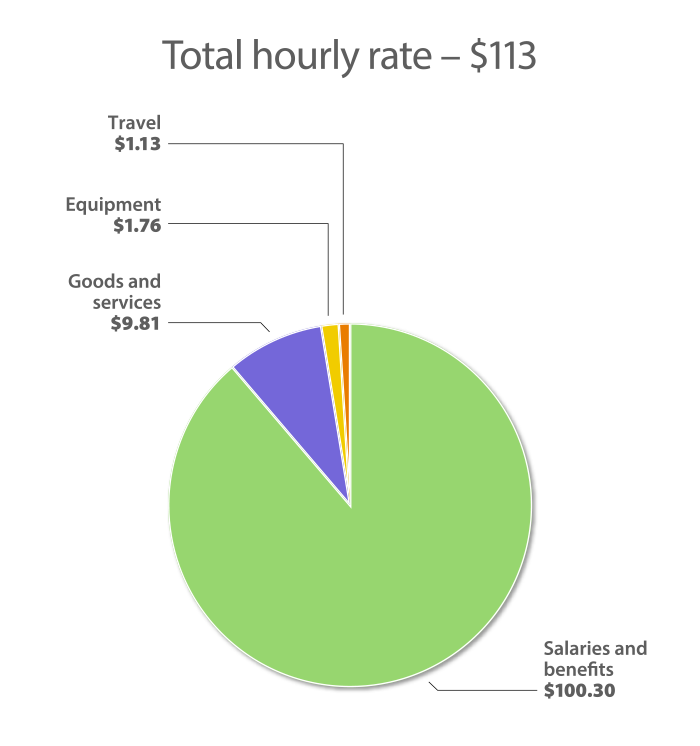

Beginning Jan. 1, 2020, the local audit billing rate will be $113, due largely to significant salary increases that have affected all state employees.

The state Legislature in recent years has been increasing salaries for state employees, including those who work for the Office of the Washington State Auditor. Calendar year 2019 alone has seen a 5% increase for all employees. Additionally, another 3% adjustment goes into effect in July 2020.

Our goal is to maintain this adjusted hourly rate for the next two years, through 2021. However, we evaluate our audit rates every year and are committed to continued communication of any future rate adjustments.

DETAILS OF NEW RATE

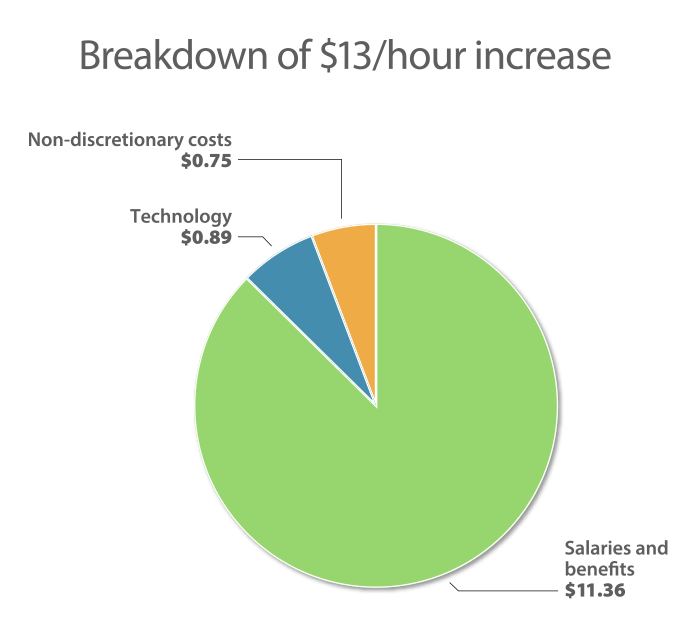

The great majority of a local government's audit bill goes straight into local audit teams. Of the $13 an hour increase, $11.36 pays for salary and benefit increases such as those mentioned above as well as other statewide salary adjustments, such as reclassifications. This rate adjustment is based on maintaining current staff levels. We do not plan to use any portion of this increase to pay for additional employees.

The remaining portion of the rate increase breaks down this way:

- $0.75 for non-discretionary costs – in other words, costs that are out of SAO's control. When salaries for all state employees go up, the amount we pay for state services goes up, too. Services provided to SAO by other state agencies include legal assistance, insurance coverage and centralized technology infrastructure.

- $0.89 for SAO essential technology, such as software licensing agreements.

In addition to the adjustment to the hourly local audit billing rate, the rate for fraud investigations will increase to $210. This rate more effectively accounts for the full cost of fraud investigations and ensures that the expense of a fraud investigation is not spread out across all local governments through the local billing rate.

HOW TO MANAGE AUDIT COSTS

We know local governments work diligently to manage expenses, including the price of an audit. SAO wants to help. Before beginning work, the audit team provides an estimate of audit cost to the government. We strive to remain true to that estimate, but factors outside SAO's control can contribute to increased audit cost.

To help manage audit costs, we recommend local governments take steps to prepare for their audit. Keeping files current and complete, organizing documents ahead of time, and ensuring key staff members are available can go a long way to controlling audit costs. For more tips on preparing for an audit, you can find a tip sheet here: Preparing for audit: Tips for success

We are committed to continuing to provide and improve services local governments rely on. SAO operates the Auditor HelpDesk, an online request portal for any audit or accounting issue that governments encounter. Earlier this year, we unveiled an HTML-based BARS Manual that is easily searchable and includes a personal note-taking feature called MyBARS.

Beyond audit services provided through the local audit billable rate, SAO provides additional services to local governments that are paid for through our sales-tax funded Performance Audit program.

If you have any questions regarding this rate adjustment, please contact Director of Local Audit Kelly Collins, CPA, at (360) 902-0091 or at Kelly.Collins@sao.wa.gov.

We value your partnership and investment in good government.