Financial management policies and resources

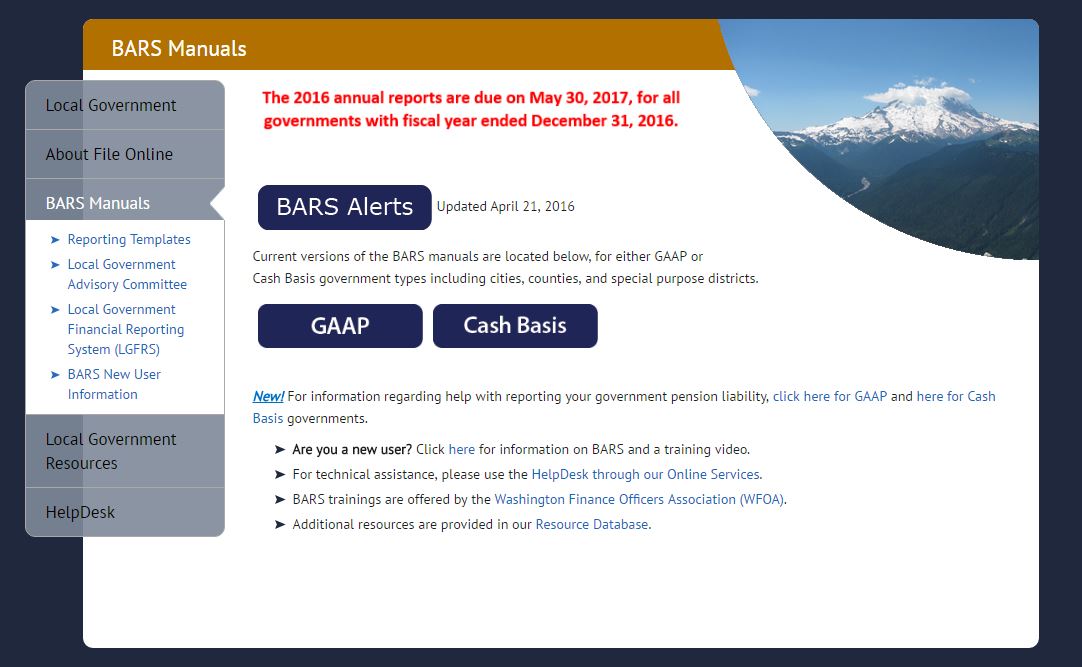

Implementing effective internal financial policies can be challenging for local governments of any size, which is why the Performance Center teamed up with the Municipal Research and Services Center (MRSC) to simplify the process.